TDS on salary happens to be a significant compliance area for HR. The interview will ask about employee business expenses job-related expenses in this section.

Ctos Lhdn E Filing Guide For Clueless Employees

As corporate offcers As members of an LLC that is treated as a corporation for federal income tax purposes and In the construction industry.

. Wages and expenses for statutory employees should be entered in the following manner. Direct sellers and licensed real. Statutory employees are regarded as.

With this box checked the income from Box 1 will not show as wages in the Form 1040 Income menu. A statutory employee is an independent contractor or freelancer thats treated as an internal employee for tax purposes. Direct sellers licensed real estate agents and certain companion sitters.

12 Interpretation a In this Agreement unless the context requires. Means the wages salaries and other amounts paid in respect of an Employee for services actually rendered to the Company or a Non-participating Company. Commercial Insurance Companies In Louisiana.

However the employer is. Statutory Payments means the payments required to be made to Government Authorities in terms of Applicable Law. HR computes an employees CTC in advance and deducts tax before crediting his account.

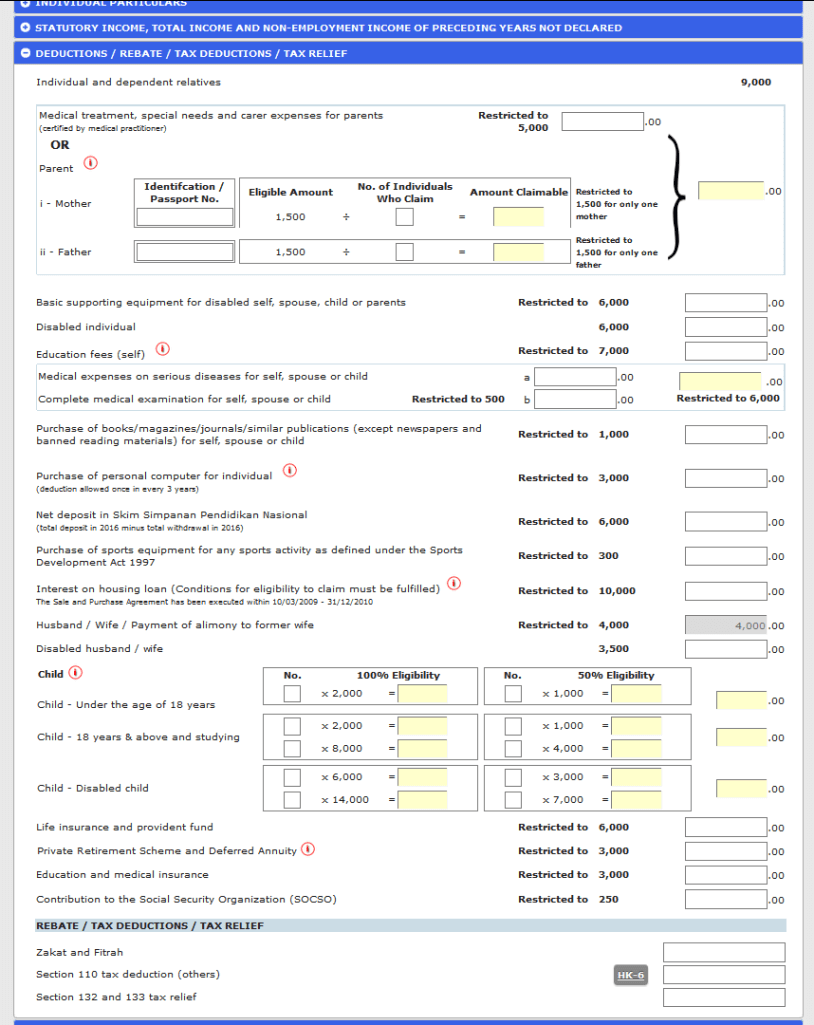

A statutory nonemployee is a worker classification that aligns with independent contractors. Enter the wages on the W-2 as you normally would then be sure to. Around tax season your employer should have provided you with an EA Form with an amount listed which youll have to key into the field titled statutory income from employment.

A statutory employee is an independent contractor under American common law who is treated as an employee by statute for purposes of tax withholdings. Paid to statutory employees. Click on Ill choose what I work on then select employment expenses.

Select the Statutory Employee. Businesses that employ statutory nonemployees do not need to withhold federal. Statutory employees are entitled to deduct their business expenses on Schedule C and must pay income taxes on their net income since their employers are not.

Jamaica Tax - Statutory Income. For a standard independent. A statutory employee is defined by the law as an employee who works for a business but the employer is not required to withhold taxes from their earnings.

There are three categories of statutory nonemployees. Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given. Enter the Form W-2 in its menu ensuring Statutory Employee is checked in Box 13.

Best Buy Policy For Price Adjustment. Individual tax rates apply.

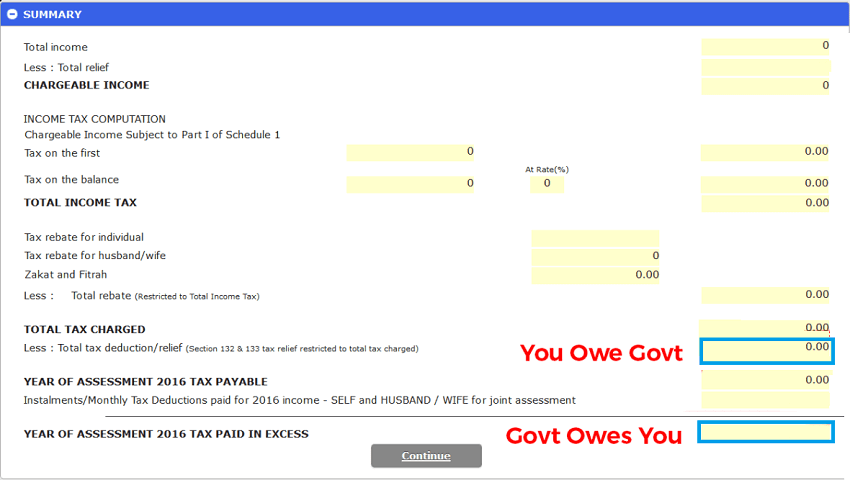

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

0 Comments